Bringing Access to Financial Services

Acquire New Customers From a Pool of 26 Million Unbanked and Underbanked Individuals and do Good at the Same Time with Cephable

Benefits of Cephable Technology in FinServe:

Revenue

NPS

Touchpoint Quality

CLV

CAC

$12,000,000,000

is sitting in front of you.

Will you leave it there?

Utilizing Cephable to capture just 1% of the unbanked and underbanked PwD community means billions of net new revenue.

Save on Costs

Bring more users to digital banking and save on staff and building costs.

Integrating Cephable brings alternative digital interaction to clientele that currently rely on expensive interactions.

%

average accessibility failure rate of online content for the websites/mobile apps of major US financial corporation

%

households with a disability used online or mobile as the primary method to access their account compared with 62 percent of households with no disability.

%

of FinServe customers are willing to change banks for a more accessible experience

Low Risk, High Reward. Just how we like it.

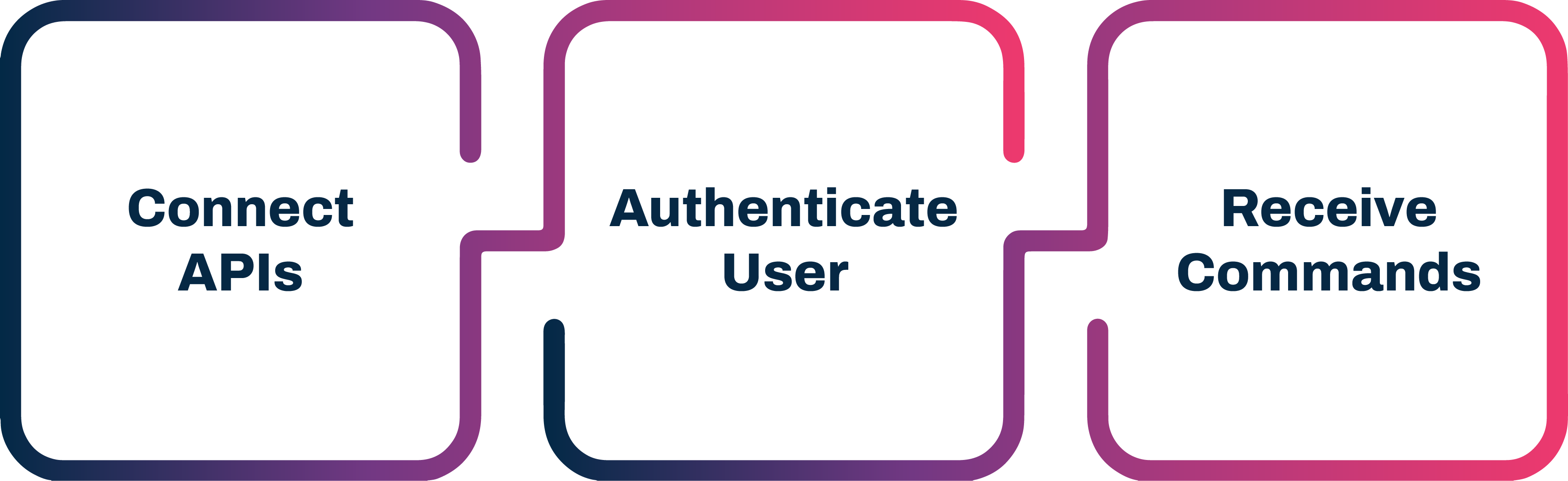

Not only was Cephable built with disability in mind, it was built with technology and developers in mind. Meaning it’s a light lift for you.

Average Implementation is 2 weeks.

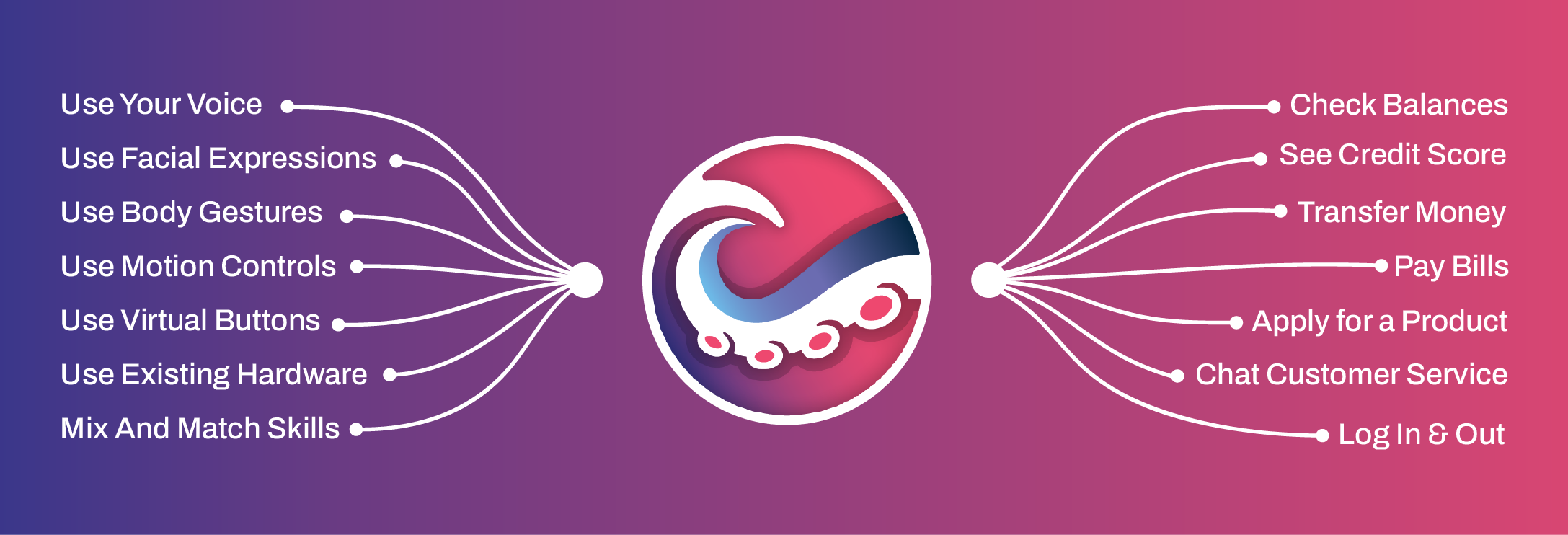

Head Motion

Voice Controls & Dictation

Tilt Controls

Virtual Buttons

Facial Expressions

Switch Control

What does Cephable look like with FinServe?